Federal OZ’s Offer Zero Taxes in 63 Queens Neighborhoods

BY SEAN CROWLEY

Despite a number of bright spots and a strengthening economy nationally, numerous neighborhoods across Queens are still struggling.

Many areas, hit hard by the Great Recession, have not been able to fully recover and have found themselves economically stagnant, or worse off, than they were even two decades ago. As the cost of living and doing business has continued to rise, a lot of new business development opportunities have shrunk.

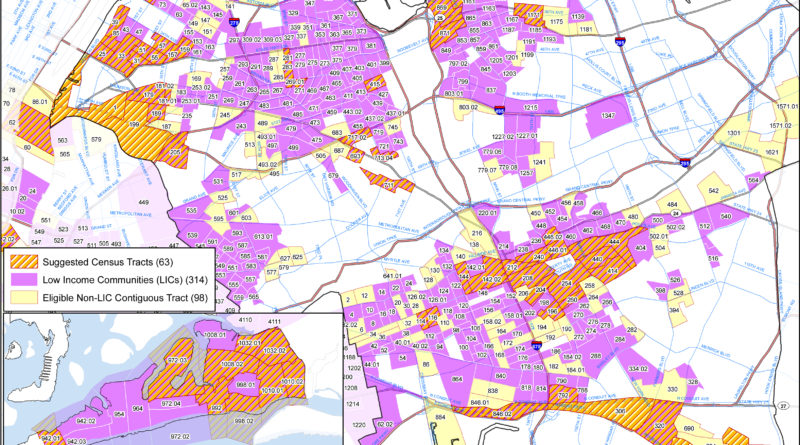

As part of the “Tax and Job Acts of 2017,” Congress created the Opportunity Zone (OZ) program to encourage private investment in low-income communities. Here in Queens, 63 different census tracts throughout the borough, including large areas of Jamaica, St. Albans, Rockaways, parts of Sunnyside and southeast Long Island City, have been designated by Governor Andrew Cuomo as eligible.

The federal OZ program provides incentives for those willing to invest robustly in return for potentially no tax being levied on their long-term capital gains. In total, Governor Cuomo has suggested more than 300 census tracts in the city and 514 statewide to the U.S. Department of the Treasury as OZ’s.

It is expected the program funding model will enable a broad array of investors to pool their resources in designated OZ’s, increasing the scale of investments going to underserved areas and bringing much-needed capital to neighborhoods that have long needed it.

The Treasury describes an OZ as a low-income census tract with an individual poverty rate of at least 20 percent and median family income no greater than 80 percent of the area median.

There are three tax incentives for investing in these designated OZ communities, but it must be done through a qualified Opportunity Fund. All involve the tax treatment of capital gains and all are tied to the longevity of the investment, with the most upside going to those who hold their investment for ten years or longer.

This encourages investors and entrepreneurs to make long-term, sustainable commitments to communities and brings capital to underserved areas on a continuing basis to produce lasting value.

One tax upside is temporary deferral on including taxable income for capital gains that are reinvested. Alternatively, there’s a step-up in basis for capital gains that are reinvested in an Opportunity Fund. The basis is increased by 10 percent if the investment is held by the taxpayer for at least five years and an additional 5 percent if it’s held for at least seven years.

Finally, there is a permanent exclusion from taxable income of capital gains earned from the sale or exchange of an investment if it is held for at least 10 years. This only applies to gains accrued after an investment in an Opportunity Fund.

The Treasury Department and the Internal Revenue Service will be providing additional guidelines in the coming months, and with this you can expect this program to take off.

In Queens, neighborhoods like Long Island City are ideal for investors ready to move quickly, as many areas of these neighborhoods are already booming. The OZ program has the capacity to open doors to new industries locating and growing in neighborhoods that made the cut, creating economic ripple effects that will lead to more jobs and more spending power by local residents.

U.S. households held some $3.8 trillion in unrealized capital gains at the end of 2017, and corporations held $2.3 trillion. That is a staggering amount of potential capital sitting on the sidelines that could be used as a down payment on future prosperity for millions of Americans.